Your Property Insurance Claim Experts Tornado & Windstorm Damage Insurance Claims

Tornado and windstorm insurance claims are complex, time-consuming, and stressful. Our licensed public adjusters manage your property insurance claim so you can focus on your business. We:

- Thoroughly review your policy.

- Document and quantify all damages and lost income.

- Prepare a comprehensive strategy.

- Negotiate a fair and just settlement.

We leverage our expertise and exclusively work for you to ensure you get everything you are entitled to under the terms of your insurance policy.

How We Help

Since 1924, we have been the recognized leader in managing tornado and windstorm damage property insurance claims for businesses. We thoroughly review your policy, noting any exceptions, to create a comprehensive claims strategy that meets your needs.

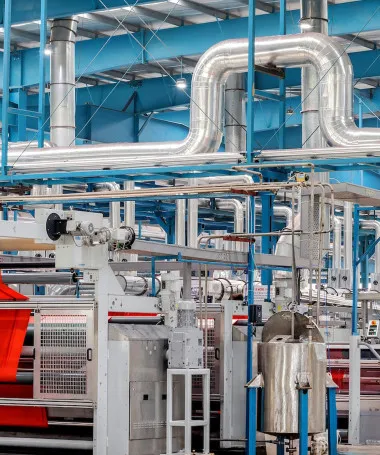

Our team thoroughly evaluates your property, equipment, and inventory damage, including lost income from business interruption. Then, we present an itemized claim package to your insurance company and negotiate the best settlement possible from your policy.

Before you engage with your property insurance company, consider the following questions:

- How can I help the insurance company understand the extent of my tornado or windstorm damage?

- What is the difference between a licensed public adjuster and an insurance adjuster from my insurance carrier?

- How much time will I need to dedicate to handling the insurance claim?

- What is my insurance agent's or broker’s role in the process? When faced with supporting my position, with whom will they stand?

- Am I entitled to an advance payment from the insurance company?