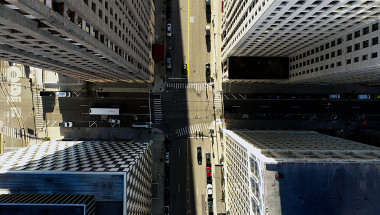

Office Properties

As the owner or manager of a commercial office property, the losses incurred by a natural or man-made disaster can be devastating. Your tenants and the decision of whether or not to rebuild are your priorities. You do not need the extra worry and stress that come with navigating the insurance claims process.

As your licensed public adjusters, we evaluate, document, and negotiate not only the physical damage to your property, but also the income lost from business interruption and the extra expenses that are incurred.

Our team understands the complexities of the insurance claim process and leverages our expertise to optimize your settlement.

-

1

Your office building just suffered serious property damage and you are wondering what to do next.

-

2

You call your insurance company and wait for an adjuster to arrive, assuming you’ll receive what your insurance policy states you’re covered for. Afterall, that’s why you’ve been paying your insurance premiums all along, right?

-

3

As a client of your insurance company, your claim is now a liability on its financial statements.

We Can Help

Knowing everything you possibly can about the "fine print" of your insurance policy before you have substantive dialogue with your carrier is critical. Understanding what you are covered for and how to claim it is where our experience starts to be of value.

Choosing what to say to your insurance company's adjuster and how you say it makes a dramatic difference in how much and how quickly you get paid. Globe Midwest™ Adjusters International's public adjusters are experts in insurance claim negotiation.

The more you know, the better the results, so turn to the firm who has been in the field since 1924 and has the repertoire of satisfied clients to prove it.

Factors To Consider

Be sure to understand each of the following factors before engaging with the insurance company. Knowledge is the key to a successful claim outcome.

- How quickly can I start rebuilding?

- Is the insurance company using an independent building or equipment consultant to prepare a bid? Who are these consultants and who are they working for?

- Are replacement properties an option for me? Would a lease purchase strategy be beneficial?

- What happens if I open my office elsewhere and I am successful? What happens if I am not successful?

- How does my insurance policy address increased costs due to new codes? If my insurance coverage is limited, what can I do about it?

- Should I have concerns as to how my insurer deals with pollutants, hazardous materials, lead and asbestos?

- How do I deal with lead and asbestos? What if my coverage is limited?

- What is my broker/agent’s role?

- Does the adjuster work for me or the insurance company? Why should this be a red flag?

- How can the way I present my story affect my recovery?

- Do I know my insurance policy provisions?

- Does the insurance company pay for the necessary professionals to accurately evaluate my claim?

- Is there coinsurance in my policy? What does it mean?

- How is actual cash value determined? Why should I care?

- What is the difference between a schedule of values and a schedule of limits?

- Can I recast my financial statements? If so, why?

- What are extra expenses and what can be included? Can I use extra expenses to offset shortfalls in property coverages?

- What are expediting expenses? How do they differ from extra expenses?

- What is the extended period of indemnity, and how does it work?

Had you been handling and guiding the preparation and presentation of all our damage estimates from the beginning, our recovery could have been far greater. I speak from experience when I say that estimates given "off the cuff" and without consideration of all the insurance policy's provisions can come back to haunt you.

Select References

- The American Legion Department of Illinois Post #1080

- Bay Valley Resort

- Best Western Waterfront

- Board of Public Utilities

- Boyne Highlands Resort

- City of Highland Park Michigan

- Comfort Inn and Conference Center Westport

- Curt A. Benson, PC

- Demarco and Sage, PC

- Dick Rayl & Associates

- Gremor Motor Inns

- Griswold Holding Company

- Judy E. Bregman

- Knollenberg for Congress

- Palisades Yacht Club Lake of the Ozarks

- Ramada Inn & Conference Center

- Stancato & Tragge, PC

- Stuart Avenue Inn

- The Taubman Companies

- Town of Sullivan's Island

- Varnum, Riddering, Schmit, Howlett LLP