News Cybersecurity Alert: Homeland Security Issues National Terrorism Advisory

News

All News

The Michigan Department of Insurance and Financial Services (DIFS) has issued Bulletin 2025-12-INS to guide how insurance companies can utilize…

Following a recent DHS advisory warning of increased cyber threats, Globe Midwest™ Adjusters International urges business owners to strengthen their cybersecurity protocols. As experts in cyber-related insurance claims, we’re here to help policyholders recover fully when attacks occur.

Globe Midwest™ Adjusters International attended the Big I 2025 Sales & Leadership Conference in Traverse City, where nearly 200 insurance professionals gathered for impactful sessions, keynote speakers, and networking opportunities.

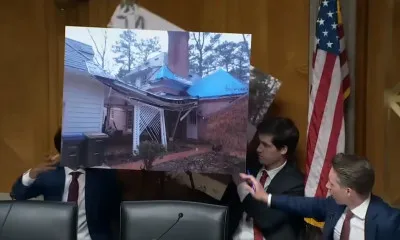

In the wake of devastating natural disasters, homeowners rely heavily on the insurance company to provide fair and accurate assessments of property damage.

Globe Midwest™ Adjusters International was proud to attend Nageela @ Topgolf 2025, held May 28 in Schaumburg, IL.

Globe Midwest™ Adjusters International was proud to sponsor the “Hole-in-One” contest at the 2025 MIPIA Golf Classic, hosted by Michigan Property Insurance Association (“MIPIA”).

Leonard Cradit, Regional Vice President of Globe Midwest™ Adjusters International, recently took part in the Grand Rapids Chamber’s Leadership…

Spring storms in the Midwest often cause hidden damage that can go unnoticed until it’s too late, but with expert guidance from Globe Midwest…

Globe Midwest™ was honored to participate in the Small Business Association of Michigan’s (SBAM) “Owner 2 Owner” (O2O) event, held at Peckham Inc. in Lansing, MI.

Spring is the perfect time for commercial property owners to assess and maintain key systems, reducing liability and preserving assets. Priorities include HVAC, drainage, structural integrity, fire safety, security, and insurance reviews.

The Globe Midwest™ Healthcare Team attended the eCap 2025 Healthcare Summit in Miami, connecting with industry leaders to discuss nursing home investment, operations, and management.

For insurance agents and brokers, understanding Contingent Business Interruption (CBI) coverage is crucial, especially for clients reliant on third-party vendors or suppliers. CBI insurance is designed to protect businesses against revenue losses stemming from disruptions in the supply chain, ensuring operational continuity despite external challenges.