Trusted Advisors: How to Calculate the Risk Probability Number (RPN) for Your Client’s Disaster Preparedness Plan

How to help your commercial property owner and business clients avoid dangerous assumptions about the “risks” facing their business.

As discussed in the first article of our series, Trusted Advisors such as attorneys, accountants, and financial advisors are truly “worth their weight in gold.” When one of your clients suffers a potentially life-changing natural disaster that affects their business and needs advice, it is likely they will turn to you. For a Trusted Advisor, this conversation represents a “moment-of-truth” in the relationship with your client.

The outcome of that “moment-of-truth conversation” can be greatly influenced by how well your client was prepared for the catastrophe they just experienced.

This second article in our Trusted Advisor series offers you information to facilitate the conversations with your client to provide an awareness of their need to prepare for potential disasters. We will arm you with a simple approach to help your clients self-identify flawed assumptions about disaster planning and replace them with sound ones. Your clients will then be able to take the steps needed to better prepare their business to survive a disastrous event and thrive after recovering from it.

The conversation must begin by challenging your client’s existing assumptions about the risks their business might face from catastrophic events, which may be flawed or out-of-date. For instance, did they consider the impacts of a pandemic on their business before COVID-19? What about the possible long-term effects of climate change on their business?

Have they asked themselves:

- What catastrophic events might they encounter in the future?

- How likely is each type of natural or man-made disaster to happen over the long-term planning horizon of the business?

- And how severe could the impact be?

Of course, while experience is an invaluable guide to help plan for a potential future event, novel events may still occur creating new challenges to full recovery. Your client’s answers to the above questions will help to dictate which risk management strategy would best suit their business. There are multiple strategies, but the most common are:

- Mitigation, i.e., take actions that reduce the likelihood and/or the severity of the event’s impact,

- Contingency, i.e., plan for continuity of the business despite the catastrophic event,

- Share the risk, i.e., insurance

Whether your clients know it or not, they may have already made assumptions about their ability to avoid and to recover from a disaster. For instance, not having any plan for a particular catastrophic event implies the assumption has been made (consciously or unconsciously) that the event is unlikely to occur, or if it does, that it will have a relatively minor impact on the business.

Recognizing and then rethinking those possibly flawed assumptions should be a major goal of these conversations. Identifying flawed assumptions and replacing them with more realistic ones is the first step towards improving your clients’ readiness for catastrophic events.

To guide these conversations, we recommend that you follow a simple, effective framework to share with your clients so they can rethink any dangerous assumptions and take the steps necessary to position their business to prepare for and then survive and thrive following a catastrophic event, such as fire or water damage, hurricanes, tornados or other unexpected occurrences.

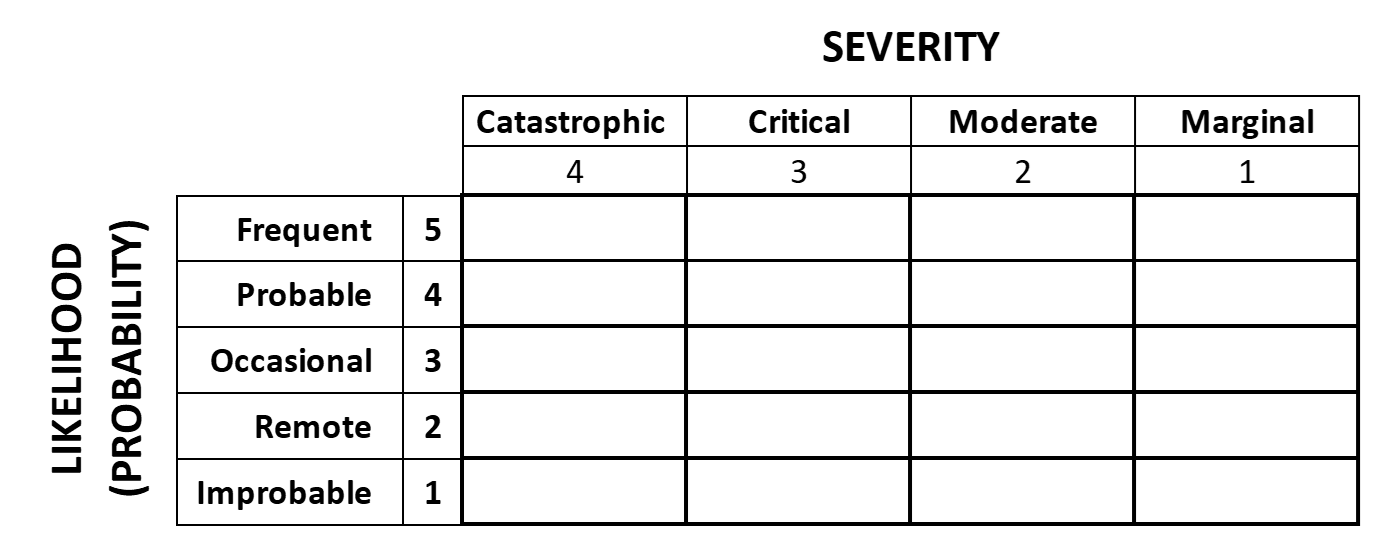

This approach is centered on three activities: (1) identify possible adverse events, (2) assess the probability of each event, and (3) rate each event’s potential severity. With the latter two in hand, a Risk Probability Number (“RPN”), can be assigned to each event. The goal is for clients to identify and, using the RPN, rank events that could disrupt or potentially destroy their business.

In the chart above, we defined five levels of probability and four levels of severity and assigned numerical values to each. This will allow you to rank events, based on their RPN.

Let’s take a practical example to show how to use this tool.

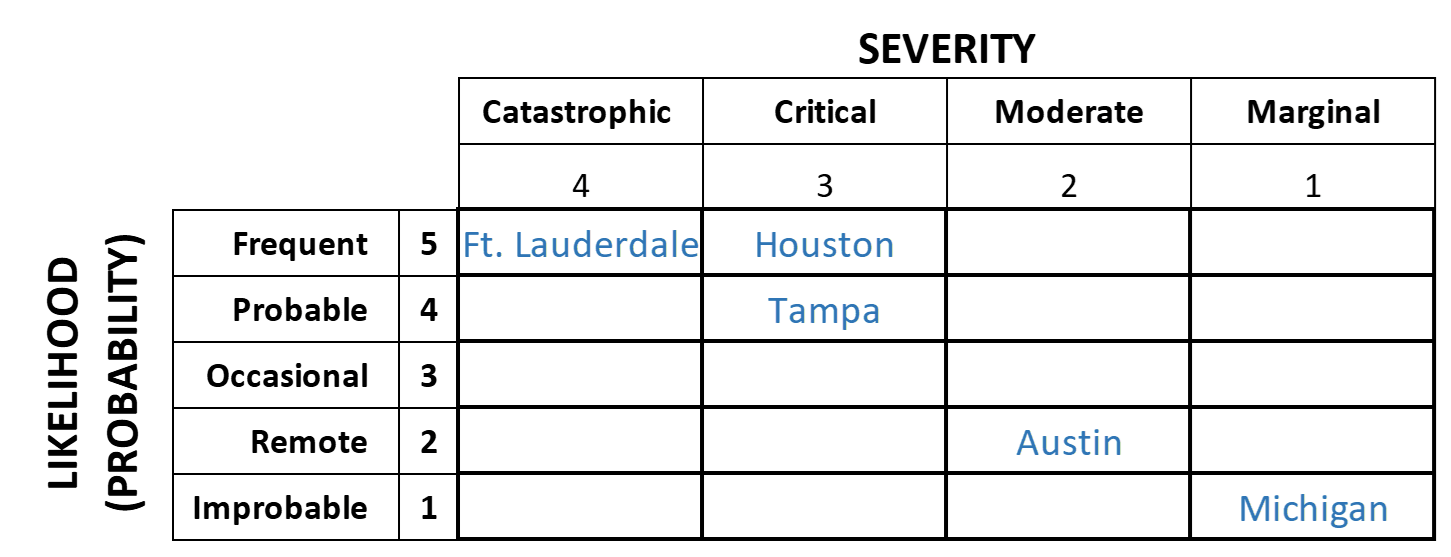

Suppose you have a client that owns a dozen commercial properties, located in Florida (Tampa and Ft. Lauderdale), Michigan (Detroit and Grand Rapids) and Texas (Houston and Austin). What do we know? The client’s properties in Florida and Texas are more prone to experiencing a hurricane than the properties in Michigan. In fact, we would consider a hurricane event to be improbable for the Michigan properties. Summarizing the estimated “Likelihood” that the client determined for their properties by geography:

- Florida: Probable (Tampa) to Frequent (Fort Lauderdale)

- Texas: Remote (Austin) to Frequent (Houston)

- Michigan: Improbable (Detroit, Grand Rapids)

The overall RPN is determined by considering the product of likelihood and severity, as noted earlier. So, the next step in determining the RPN for your client’s properties requires an estimate of the severity of the impact that a natural disaster such as a hurricane could have on each property, based on location and other relevant factors, such as type of construction, proximity to areas prone to flooding, et cetera and then summarizing the estimated “Severity” by state, based on historical property damage records and all other relevant factors.

Example:

- Florida: Critical (Tampa) to Catastrophic (Fort Lauderdale)

- Texas: Moderate (Austin) to Critical (Houston)

- Michigan: Marginal (associated with possible flooding due to hurricane remnants)

Severity can be made more specific, if desired, by estimating potential loss ranges for each of the four levels, for instance, Marginal: <$50,000, Moderate: $50,001-$250,000, Critical: $250,001-$1,000,000, Catastrophic: > $1 million.

The following is an example of a completed severity analysis:

Of course, this only considers one of many possible events that can pose a risk to your client’s properties. A similar analysis should be done for the many other possible risks, to create a complete risk profile.

In the next article we’ll discuss how this approach can be used to explore more possible risk-management strategies that your clients can consider, and how you can help them create a tailored strategy using the simple tools we introduce in these articles. We will continue to use some simple examples to ensure you are positioned to easily convey this approach to your clients.

Download this blog as an eBook by clicking here.

As the Midwest’s largest and oldest public adjusting firm, Globe Midwest™ Adjusters International’s core focus is exclusively representing property and business owners, during the insurance claim process, to maximize and expedite our clients’ insurance claim settlement. With offices in Southfield and Grand Rapids, Michigan, Chicago, Illinois, and Appleton, Wisconsin we are experienced with the types of natural disasters that strike the Midwest, the companies that insure here, and how local claims are handled.