What You Don't Know Might Hurt Your Client

The Complex and Challenging World of Property Insurance Claims

by Ethan A. Gross and Stuart M. Dorf

As Featured In Laches: Oakland County Bar Journal! - August 2019

One of the goals as a legal professional is to be "more" to our clients: more than a zealous litigator, a contracts wordsmith or a skilled negotiator. And somewhere during the course of representing your client, you do become more to your client, especially as he or she starts to view you as a trusted advisor - someone they can turn to in their times of need regardless of whether it is in your area of expertise!

While trusted advisors cannot be experts at everything, it is important they do have a working knowledge of certain events that are likely to present issues in the lives of their clients. The world of property insurance claims is one such field. Whether your clients own a home, commercial property or both, it is likely they have an insurance policy to cover their risk.

But having insurance and using insurance (when a claim is made) are two completely different things. Accordingly, the purpose of this article is to provide trusted advisors who do not specialize in first-party property insurance claims a basic understanding of the structure of a property insurance policy and what their clients will encounter when making a property damage insurance claim.

Understanding Where to Look

Sometimes clients do foolish things like unilaterally enter into contracts they do not read that can affect their largest assets, all the while never bothering to get advice or counsel from you, their trusted advisor! If this does not sound like your client, think again - it is. Your client did exactly that when they bound coverage on their property insurance.

At its core, an insured's relationship with their insurance carrier is contractual in nature and is governed by a contract more popularly known as an insurance policy. Please remember, an insurance contract is not just any old contract - it is unique, as it is an adhesion contract, so either take it or leave it.

Since many clients do not have the option of leaving it - i.e., forgoing insurance - they enter into these contracts blindly. The fact is most insureds have never read their insurance policy, so they are completely unaware of their rights and responsibilities. Which is not to say that reading the policy is a tremendous help. The typical property insurance policy is very confusing, as it is riddled with provisions that provide coverage in one section, take it away in another, give it back in yet another section, etc. Most insureds tend to assume they are fully covered so they do not bother with a thorough review of their policy. But "fully covered" is a myth. No insurance policy exists that covers everything.

From a trusted advisor's perspective, general principles found in common law and even case law regarding liability and damages (in regard to torts) as well as standard contractual issues, for the most part, do not apply. Rather, all the rules of the game of making an insurance claim - all the requirements, obligations, timeframes, even methods of dispute resolution are for the most part contained within the provisions of the policy. Regardless of whether this is fair or equitable, it is critical to understand the rules of the game and how to comply with them for your client to properly submit their claim and receive the fair and just settlement they deserve.

It is important that trusted advisors have a very basic understanding of the documents they are looking at in the event a client contacts them about an insurance claim. Often when clients refer to their insurance policy, they are usually speaking about one of two documents: either the "dec sheet" or the "body of the policy" A quick overview of each follows.

The Declarations Sheet

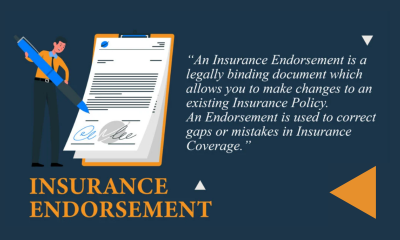

Many clients initially think the declaration page, aka the dec sheet, is the entire insurance policy. It is not. The dec sheet identifies the type of property being insured, coverage limits and deductible amounts. Dec sheets also identify additional types of coverage that may not appear in the body of the policy but are offered through an endorsement. The dec sheet does not provide the details

of coverage; those details are contained in the body of the policy and all related forms and endorsements.

The policy divides coverages into three primary categories. There also are numerous other coverages throughout the policy, but the three primary coverages are building, contents and time element:

- Building — This category covers the physical structure including items permanently affixed to the structure. In residential policies this coverage is often listed as "Coverage A-Dwelling." In commercial policies, it is typically referred to simply as "Building."

- Contents — This covers all items that are not attached to the building/dwelling. As we like to say, "If you take the building, flip it over and shake it, everything that falls out is "contents." In residential policies this is referred to as "Coverage C-Personal Property"; in commercial policies it is referred to as "Business Personal Property."

- Time Element Losses — This category provides coverage for additional expenses and/or loss of income suffered by an insured. In residential policies this is referred to as "Coverage D-Loss of Use" or "Additional Living Expenses" and covers the additional cost incurred if a homeowner is forced to live in a temporary accommodation following a covered loss. In commercial policies the time-related coverages are referred to as "Loss of Income" and "Extra Expense." In general, these cover the lost profits as well as other expenses incurred to attempt to maintain operations or minimize lost profits after a covered loss has occurred.

The Body of the Policy

As the old adage goes, "The devil is in the details" and this is especially true when it comes to reading the body of your client's insurance policy. There are numerous provisions in insurance policies; all are important. With all of the fine print it is extremely important to read the entire policy to understand how the various provisions impact your client's coverage. For purposes of this article we will only address a few key provisions that will always apply.

Definitions. Words and phrases in bold are terms that will be defined in the definitions section. It is critical to see how the policy defines these words and phrases, as the definition impacts the coverage.

Covered Property/Property Not Covered. As the headings indicate, this section identifies what physical property is covered by the policy and what is not. Please note, many policies have additional coverages via endorsement that are not subject to the policy limit, but rather have their own sub-limit.

Covered Causes of Loss. As mentioned, there is no such thing as "fully covered." This section identifies the types of risks that are covered. Most policies are either "open perils" aka "all risk," or "named perils." An open perils policy covers everything that causes physical damage to covered property - except the numerous perils that are excluded or limited elsewhere in the policy. A named perils policy only covers damage caused by the specific perils listed in the policy, such as fire, lightning, wind, etc.

Exclusions and Limitations. Where the insurance policy grants coverage in one section, they "taketh away" in another; the exclusions and limitations sections are where coverage is minimized / limited. These must be looked at closely, as there are often exceptions built into the exclusion or limitation that may actually allow for coverage in certain circumstances.

Loss Conditions/Additional Conditions. This section contains miscellaneous conditions and requirements of the insured. These conditions address everything from the insured's duties to the rights of others.

Preparing and Presenting the Insurance Claim

There is a misconception held by most clients that all they have to do to get compensated for a property damage loss is pay their premium. Well, nothing could be further from the truth! Paying an insurance premium is the first step - not the only step - your client must take in order to receive a full and just settlement. Remember, your client already agreed to a number of affirmative obligations when they bought their insurance that only "spring to life" once a claim is made. These duties are usually found in the loss conditions subsection titled "Duties in the Event of Loss of Damage."

Failure to comply with any or all of these duties may result in a denial of the claim. These duties include, among other things, providing prompt notice of the loss, protecting the subject property from further damage as well as the "duty to cooperate," and providing any and all financial, tax, utility or other documents requested by the insurance company in a timely fashion. The most cumbersome and difficult of the obligations placed on your client is their duty to prepare and present their claim to the insurance company.

Additionally, there is a requirement to submit a "Sworn Statement in Proof of Loss." This critical document must include certain information, including the amount of the claim. This must be properly completed, signed by the insured and notarized. By statute this must be submitted within 60 days of the date of loss, unless the time is extended in writing. Many policies provide that the proof of

loss is due upon request, which extends the time for filing until requested.

Practice Alert: Michigan courts have upheld claim denials for merely failing to file the proof of loss on time. This is an extremely harsh result; as such, it is important to make your client aware of this deadline. While the policy tells your client what they need to do, no one is telling your client how to comply with these obligations. For example, "damages" in the world of property insurance are documented using means and methods unique to the insurance industry that are very different from the real world or what our clients would consider common sense. Failing to be aware of how to work within these standard industry practices can be devastating to an insured's recovery.

For instance, in determining loss of income, the insurance policy sets forth a very specific formula for calculating a loss of income claim. A CPA unfamiliar with the formula and related rules may prepare a calculation that seems logical, but when reviewed based on the terms of the policy, may in fact be too high or too low and end up being rejected by the insurance carrier.

The same concepts hold true for building and contents claims. In identifying the amount of loss and damage to repair a building following a fire or other event there are means and methods used in the industry that are customary. A repair estimate that does not follow these is less likely to be accepted. Similarly, contents claims that are not identified according to industry practices are also not accepted, creating more work and less recovery for insureds.

Leveling the Playing Field for Your Client

In large losses, the insurance carrier will often hire a team of experts to review and/or calculate the claim; remember the relationship the insurance carrier has with your client is and always has been about business, not personal. This team will include forensic accountants, building consultants, inventory specialists, and other consultants as needed. All of these consultants work directly for the insurance company and are typically looking out for the best interest of the insurance company. As most insureds are not experts in any of these fields, this gives the carrier and their experts an unfair advantage in the insurance claim negotiations and creates an unlevel playing field.

Your Client has the Right to Hire Their Own Experts

When preparing the claim, it is important the insured take the time to read and understand the policy as well as thoroughly document their losses. Most large losses contain enough complexities that the insured should seriously consider retaining their own experts to assist them with the process.

As a trusted advisor, it is important you understand the resources and experts available to your clients in the event they make an insurance claim. These experts may include their own forensic accountants, building estimators, content specialists and engineers. Additionally, they will also need an expert familiar with the policy and the process who knows how to prepare the claim in the format the insurance company will understand. And, in many cases, the insured will need counsel to deal with direct claim-related issues as well as ancillary issues resulting from the claim, such as landlord-tenant issues, vendor/service contracts, customer issues (contractual fulfillment and otherwise), etc.

Your insured also has a right to hire their own insurance adjuster. Adjusters who work exclusively for policyholders, not insurance companies, are called public adjusters. Public adjusters are licensed by the State of Michigan to represent insureds in preparing, presenting and negotiating their first party property claims. Professional licensed public adjusting firms often have most of the needed experts on staff and are familiar with the many duties and obligations placed on your client by the terms of the insurance.

An experienced and knowledgeable public adjuster can help level the playing field by advocating for the insured. As the saying goes, "You don't know what you don't know." Many insureds settle claims for substantially less than they were entitled to recover without realizing they left money on the table. That is where the right experts can make all the difference. Of course, as with all professions, if a public adjuster is needed it is important to interview them to confirm they have the capabilities to handle your client's specific claim.

Methods of Dispute Resolution

Property insurance claim disputes, like most disputes, can often be resolved through good-faith negotiations. When an amicable settlement cannot be reached, then resolution of this otherwise typical contract dispute becomes anything but typical.

Dispute resolution in property insurance claims are governed by the insurance policy itself and the Michigan Insurance Code. The insurance code has numerous provisions that may impact the litigation and the resolution. We can only touch on a few of these provisions in the remainder of this article.

The most significant provision in the insurance code when it comes to property insurance claims is MCL 500.2833 - "Fire insurance policy; mandatory provisions; coverage." This statute, and the provisions contained therein, provide substantial governing law in regard to property insurance claims and dispute resolution. MCL 500.2833 provides that all fire insurance policies shall contain the provisions set forth in MCL 500.2833. While the statute specifically references fire insurance policies, most property insurance policies cover a variety of risks in addition to fire; as such, all the provisions would apply. Property policies that do not cover fire - i.e., a flood-only policy may not be subject to this statute.

In property damage claims there are two main categories of dispute: coverage, and valuation of loss and damage. Coverage disputes may involve drastic matters such as a carrier denying a claim due to alleged arson by the insured. Other coverage disputes may only involve portions of a claim; for example, an insurance company may agree that a claim is covered, but there is a dispute over how a particular coverage is applied. As with other contract disputes, irreconcilable coverage disputes must be

resolved in litigation.

In regard to disputes over valuation, these typically revolve around the cost of repair or replacement, the depreciated value of repairs or replacement, and the value of the property prior to the damage, all of which may have implications in regard to possible amounts payable. Uniquely, when there is a dispute over valuation only, litigation is not an available method of dispute resolution. Rather, a process called appraisal, which will be addressed below, is the only method of resolution.

Litigation

When coverage issues cannot be resolved, then the proper recourse is litigation. There are several key factors to be aware of when approaching property insurance litigation, including the statute of limitations and bad faith. As it pertains to the statute of limitations, under a fire insurance policy the time limit is one year, unless extended in writing. It is important to read the policy, as there is typically a provision in the loss conditions titled "Legal Action Against Us" that will set forth the time period for suit.

Notably, Michigan, unlike most states, has a statutory tolling provision for fire insurance policies. The statute provides that the "time for commencing an action is tolled from the time the insured notifies the insurer of the loss until the insurer formally denies liability." Property insurance claims can take more than one year to resolve for a variety of reasons. Tolling is a great provision that allows the insured and insurer to continue to work together to resolve the claim without forcing the insured into litigation for the sole reason of preserving their rights.

Bad Faith/Extra Contractual Damages/Penalty Interest

In the event a claim cannot be resolved and litigation is filed, the question of bad-faith damages always comes up. While many states have strong bad-faith laws to protect consumers of property insurance, Michigan is very limited in terms of any type of bad-faith protections. For the most part, an insurance carrier can deny a claim in Michigan for any reason and not be subject to any bad-faith penalty or punitive damages.

There is some case law to support arguments for extra contractual damages in the event the insurance company is found to have been in breach of contract. Even extra contractual damages are difficult to recover.

One remedy that consumers in Michigan do have is the right to recover 12 percent penalty interest on delayed payments by an insurance carrier. Insurance claims must be paid within 30 days after the insurer receives proof of the amount of loss. If the insurance carrier fails to make payment within 60 days of proof of the amount of loss, then pursuant to the Unfair Trade Practices Act, the insurer must pay 12 percent interest starting on day 61. While this interest is often referred to as penalty interest, there is no requirement that the insurer act in bad faith when not issuing payment. It is also irrelevant as to whether the amount owed was reasonably in dispute. Any amounts paid after 60 days from the submittal of the proof of the amount of loss is subject to the 12 percent interest.

Statutory Appraisal

When there is a dispute regarding the actual cash value of the property or the amount of the loss under a property insurance policy, the only remedy is statutory appraisal. While technically a form of alternate dispute resolution, statutory appraisal is not voluntary. The parties cannot unilaterally opt out of the appraisal process and resolve these non-coverage related disputes in litigation. Once either party demands to submit their differences to appraisal, it must go to appraisal. Statutory appraisal is very similar to arbitration. The details of the appraisal process are set forth in the statute, but in a nutshell, the insured and insurer each select an appraiser. The two appraisers then choose a neutral umpire. This creates the appraisal panel. Once any two of the three members on the appraisal panel agree on the amounts, they sign an appraisal award, which becomes binding.

Appraisal is a substitute for judicial determination when it comes to determining value. It is an informal process so the rules of evidence do not apply and the format of each appraisal can vary substantially. Once entered, the appraisal award is binding on the parties. Appraisal awards may only be set aside by the court in cases of "bad faith, fraud, misconduct, or manifest mistake."

When disputes arise and statutory appraisal is demanded, there may be some gray areas as to whether an issue is a coverage dispute or a valuation dispute. Some carriers have attempted to argue that the scope of damage - i.e., how much drywall must be replaced is a coverage issue and that only the cost of the drywall, for example, is subject to appraisal. That is not the case. Both scope and costs are part of the valuation and are subject to appraisal.

Conclusion

Property insurance claims are complicated. The insurance policy creates a minefield of issues that, if not properly navigated, can blow up and destroy the claim. In a large commercial claim, it will typically involve a bevy of experts on both sides to identify the damages and negotiate the complex terms of the policy. Add a coverage dispute, and the complexity increases exponentially.

For the trusted advisor unfamiliar with the field of property insurance who is approached by a client with a claim, it is important to follow a few simple rules:

- read the entire policy

- learn about the process

- encourage the insured to obtain the necessary experts to level the playing field

- if the claim seems to be heading in a bad direction, consider consulting with attorneys who specialize in first-party property claims.

Ethan A. Gross, JD is the CEO of Globe Midwest™ Adjusters International where he exclusively represents property and business owners during the insurance claim process. Mr. Gross frequently presents on insurance claims issues to professional groups throughout the country and has published several articles on a variety of property insurance claim topics. He also presents insurance courses certified by the State of Michigan for continuing education credits. Before joining Globe Midwest™ as a fourth-generation public adjuster, he worked as an attorney specializing in first-party property insurance litigation. He is a member of the American and Michigan bar associations as well as the National Association of Public Insurance Adjusters, and is the current president of the Michigan Association of Public Insurance Adjusters.

Stuart M. Dorf, JD is an SVP at Globe Midwest Adjusters International where he specializes in exclusively representing commercial property and business owners during the insurance claim settlement process. Stuart is a member of the American, Michigan and Oakland County bar associations, and is a member of the OCBA Real Estate Committee as well as a member of the Michigan and National Association of Public Insurance Adjusters. Stuart is a licensed instructor and presents insurance courses certified by the State of Michigan for continuing education credits.