How to calculate business interruption damage in a commercial property damage claim

In determining loss of income for a commercial property damage claim, the insurance policy sets forth a very specific formula for how a loss of income claim needs to be calculated.

Someone unfamiliar with the formula and related rules may prepare a calculation that seems logical, but when reviewed based on the terms of the policy, that calculation may in fact be too high or too low, and could then end up being rejected by the insurance company.

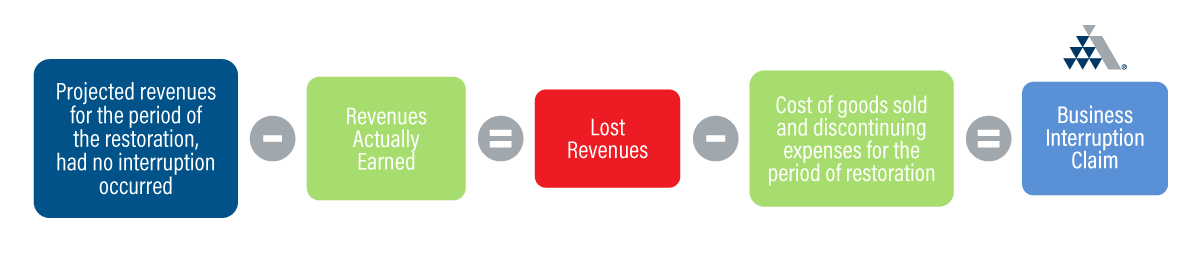

Fundamentally, a business interruption insurance calculation involves:

Costs to reduce the loss of revenues are covered to the extent that they reduce the loss. “Extra Expense” coverage may also apply. Also, please note that some policies provide that the calculation be done in reverse (starting with the net and adding the continuing expenses, etc.), which should result in the same amount.

This seems basic enough, but it is crucial for you and your client to understand that the values in this formula are subject to a number of issues, and are up for interpretation by the insurance company and the forensic accountants representing the company’s interests.

The recovery (if not, survival) of your client’s business should not rely on an opinion from the other side. In fact, it is just as crucial for your client to know that they have a right to hire their own insurance claim expert to prepare the business interruption claim and negotiate a fair and just settlement.

This expert is a licensed public adjuster, who will become fluent in your client’s commercial insurance policy and have their team of on-staff forensic accountants pour over every financial detail of the business — records for sales, production, costs of goods sold, operating expenses, inventory levels, and more.

They use this thorough analysis and information to determine accurate loss amounts and expenses and will strategize with you and your client on the recovery goals for the business.

To avoid an unsatisfactory settlement or claim rejection, get an experienced public insurance claims adjuster on your side.

Blog Article by Stuart Dorf, JD — Senior Vice President of Business Development/Marketing, Globe Midwest™ Adjusters International

For over 94 years, Globe Midwest™ Adjusters International public adjusters have successfully represented thousands of clients and secured billions of dollars in settlements for policyholders in Michigan, Illinois, Wisconsin, and throughout the Midwest.